Here are a few stories that came across my desk that I think are relevant and interesting to the powersports business community.

1 – NPA names Brian Burk as northeast territory sales manager – From Powersports Business

National Powersport Auctions (NPA) has announced that NPA Philadelphia has hired Brian Burk as the northeast territory sales manager.

Burk is a longtime motorcycle enthusiast and industry professional. As a young man, he rode his cousin’s 1979 Honda XR 70, and today he enjoys BMX racing and dirt biking with his children. Burk’s favorite ride is his 2021 Harley-Davidson FLTRXS – Road Glide Special that he takes out for weekend adventures.

In 2009, Burk entered the wholesale side of powersports. He eventually became general manager of a Harley-Davidson dealership, where he excelled at turning a profit on both new and used inventory. As an NPA dealer customer, Burk worked closely with NPA staff and learned the benefits of auctions for his remarketing and inventory demands.

Burk has come full circle from wholesale and retail back to wholesale remarketing. By joining NPA, he is able to share his experience and knowledge to help other dealers.

“I’m very excited to be on the NPA team,” he said. “It is really fun working with like-minded enthusiasts who share the same passion.”

“Brian brings many years of experience in the powersports industry as a dealership manager and most recently working with a Harley-Davidson dealer group in the Philadelphia area,” said Dusty Krepp, eastern regional sales manager. “As a regular customer at NPA, he developed a strong understanding of our company. We are fortunate to have such an experienced member on our team that can hit the ground running,”

Burk’s new territory includes East Pennsylvania, East New York, Rhode Island, Connecticut, Massachusetts, Vermont, New Hampshire and Maine, and he is excited to serve his customers with all their inventory management needs. Dealers may contact him at bburk@npauctions.com or 484.941.4245.

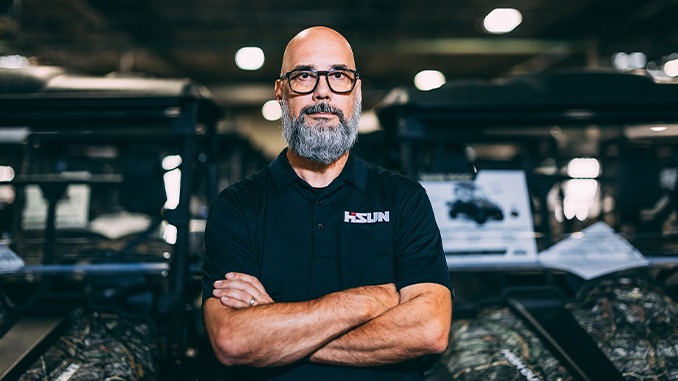

2 – HISUN USA Promotes Phil Chapman to Director of Parts and Accessories – From Hisun USA

HISUN USA is pleased to announce the promotion of Powersports industry veteran Phil Chapman to Director of Parts and Accessories. Chapman moves from his previous role as HISUN USA’s Plant Manager to his new position as Director of Parts and Accessories. In his new role, Chapman has been tasked with expanding the company’s North American parts and accessories portfolios with an emphasis on increasing profitability for the manufacturer and its dealer partners.

Chapman began working in the Powersports industry in 1995 and, before joining HISUN USA in 2021, was employed in various roles in the industry, including technical service, product planning, and product development roles for the likes of Yamaha, Suzuki, and Schuberth North America to name a few. With over 20 years of industry experience, Chapman takes pride in being a fixer and head-on problem solver. He thrives in product and process improvement environments and believes customers’ needs are best addressed when the end user is always top of mind.

“Whether it’s units that need repairing or customer accessory needs that have to be met, I thrive on problem-solving and product and process improvement,” said Chapman. “I like to plan the work, then work the plan—meaning one has to know what they are trying to fix before executing. I’m a service guy, we tend to be realists, and I’ve found that almost everything can be broken down into the problem, the cause, and the correction to find a solution. I look forward to bringing this mindset to my new role to bring our dealers and customers a true OE-level experience, whether it’s parts and accessories or ongoing product development and improvement.”

“We’re thrilled to have Phil take the helm in our Parts and Accessories division, added Vice President of Operations Jamie Cheek. “Phil will work hard to add to and round out our side-by-side accessory categories. His extensive industry experience and diverse skillset will greatly benefit our team. We look forward to seeing what Phil brings to dealer showrooms for HISUN USA customers.”

HISUN USA proudly welcomes Phil Chapman to his new role as Director of Parts and Accessories.

JOIN HISUN MOTORS USA

It’s a great time to join Team HISUN! HISUN USA continues to grow, improve, and better serve its customers with an expanding line-up of Powersports models. If you are interested in joining the team, visit the HISUN USA Careers page for current job openings. Careers at HISUN USA

FOR EVERY DAY USE

www.hisunmotors.com

3 – Zero Motorcycles selects Pirelli tires as original equipment – From Pirelli

Pirelli Tire North America has announced that Zero Motorcycles has selected Perilli tires as original equipment for its full range of electric motorcycles for 2022 and beyond. Zero Motorcycles high-performance electric motorcycles are lightweight, efficient and fast off the line, making Pirelli’s premium, high-performance tires the ultimate choice in helping put the power to the ground.

“This is an exciting opportunity for the Pirelli brand,” said Josh Whitmire, director of sales, Pirelli North America. “We live in a constantly changing world, and Zero is a brand that has taken the next step in motorcycle evolution with a direct focus on high-performance electric motorcycles. At the same time, our development is ongoing each and every day at Pirelli, and together, we see this being an extremely successful partnership that benefits and trickles down to the everyday consumer.”

The new Zero DSR/X electric adventure bike is the brand’s latest model to be introduced and comes equipped with Pirelli’s SCORPION Trail II 120/70R19 and 170/60R17 tires, which combine the best features of sport-touring and dirt-road motorcycling tires. Pirelli SCORPION Rally STR tires are also available as a performance accessory on the DSR/X for riders looking for a knobby tire but require demanding grip on-road and added traction off-road.

“Zero Motorcycles is excited to continue our long-standing relationship with Pirelli as equipment on the all-new DSR/X,” said Brian Wismann, VP of product development, Zero Motorcycles. “Whether we’re developing on-road or off-road motorcycles, Pirelli has always provided our engineers with amazing options that balance traction, efficiency and durability for our customers.”

Pirelli’s wide range of on- and off-road motorcycle tires come standard across the full Zero Motorcycle lineup. Pirelli tire models selected include the DIABLO ROSSO II on the Zero FXE and S; DIABLO ROSSO III on the Zero SR, SR/F, SR/S; MT 60 on the Zero DS and DSR; and SCORPION MT90 A/T on the Zero FX.

4 – Central Powersports Distribution announces new hire as company grows – From Powersports Business

Central Powersports Distribution (CPD) has hired Rod Overstreet as the national sales & dealer development manager for the OEM motorcycle brands that CPD represents. As a long-time industry veteran, Overstreet will be a valued addition to CPD as it continues to grow.

“We are very excited to be working with Rod, as he has the experience and passion for off-road, and that is what we are all about here,” said Mark Berg, head of operations at CPD. “Rod will continue to nourish our existing dealer relationships, while simultaneously cultivating new dealers for the brands we are partnered with. Based upon the successes we achieved in past projects, I know he is the right person for the large task ahead, especially when tackling the altered business atmosphere in the post- COVID world.”

CPD launched its operations at the beginning of the COVID pandemic, and as unit availability was scarce among all motorcycle manufacturers, CPD dealer growth was slow. As its OEM supply chains slowly continue to improve, Overstreet will concentrate on Rieju, Electric Motion and SWM dealer development to fill the gaps in the dealer network throughout the U.S.

“These are exciting times at Central Powersports Distribution, and I’m honored to be a part of this team once again as we build for the future,” Overstreet said. “Our goal is simple: make doing business fun and easy – no games or gimmicks. We strive to offer the best possible support to our dealers and to our riders.”

CPD currently imports and distributes notable OEM motorcycle brands such as Rieju, Electric Motion and SWM. Viral Brand goggles was recently added to the CPD family of aftermarket brands already in distribution, including Funnel Web Filters, S3 Parts and Trickbits Protection Parts. CPD will continue to add more aftermarket segments specific to off-road.

5 – PARTS UNLIMITED AND DRAG SPECIALTIES ANNOUNCE SPRING NVP PRODUCT EXPO – From Motorcycle & Powersports News

Parts Unlimited and Drag Specialties have announced the return of their in-person expo to Louisville, Kentucky, after three years. The NVP Product Expo held at the Kentucky International Convention Center (KICC) is scheduled for January 2023 and will kick off the spring premier selling season.

The NVP Product Expo continues to expand with an over 40% increase in exhibit space from the previous Louisville expo, and all exhibits are on one floor.

The Parts Unlimited and Drag Specialties sales force will have additional opportunities to visit vendor displays on Friday beginning at noon to get a sneak peak of what’s new for 202.

The Expo begins Saturday, Jan. 21 and runs for two full days. Exciting new brands and products will be unveiled along with opportunities to connect with the industry’s leading brand representatives. Dealers attending the expo will receive expo discounts and additional incentives. Plan to attend both Saturday and Sunday, as it takes two days to see the entire expanded expo.

Enjoy Happy Hour Saturday on the show floor then head to that evening’s iconic Meet & Greet taking place at The Sports & Social Club in the heart of downtown Louisville’s 4th Street Live Entertainment District.

Jan. 21-22 — Louisville is the place to be. Located only a day’s drive for over half the U.S. population, it’s one of the most walkable downtowns and a premier dining and entertainment destination.

Save the date and join us as the industry comes together again in downtown Louisville.

6 – PARTS UNLIMITED AND DRAG SPECIALTIES RETURN TO AIMEXPO FOR 2023 – From Motorcycle & Powersports News

Parts Unlimited and Drag Specialties are excited about our return to AIMExpo Feb. 15-17, 2023. For them, it’s another opportunity to come together with the powersports industry. Their global leadership team will be on hand and look forward to seeing everyone in Las Vegas.

The companies believe in trade shows, and its spring and fall NVPs are proof of that. Opportunities to learn about new products, market trends and the chance to build relationships within the industry are priceless.

LeMans Corp. Vice President of Sales/Marketing Jeff Derge said, “This is an important part of our industry; it’s another opportunity for Parts Unlimited and Drag Specialties to show dealers, vendors and OEMs our commitment to ‘We Support the Sport.’”

Stop by for a cup of coffee, meet the leadership team and learn what is new for 2023.

7 – Fox Factory Holding Corp. Announces Third Quarter Fiscal 2022 Financial Results – From Fox Factory Holding Corp.

Fox Factory Holding Corp. (Nasdaq: FOXF) (“FOX” or the “Company”) today reported financial results for the third quarter ended September 30, 2022.

Third Quarter Fiscal 2022 Highlights

- Sales increased 17.8% to $409.2 million, compared to $347.4 million in the same period last fiscal year

- Gross profit increased 18.3% to $137.3 million, compared to $116.0 million in the same period last fiscal year. Gross margin percentage increased 10 basis points to 33.5%, compared to 33.4% in the same period last fiscal year; non-GAAP adjusted gross margin percentage increased 10 basis points to 33.9% compared to 33.8% in the same period last fiscal year

- Net income was $50.8 million, or 12.4% of sales and $1.20 of earnings per diluted share, compared to $43.8 million, or 12.6% of sales and $1.03 of earnings per diluted share in the same period last fiscal year

- Non-GAAP adjusted net income was $57.4 million, or $1.35 of non-GAAP adjusted earnings per diluted share, compared to $50.5 million, or $1.19 of non-GAAP adjusted earnings per diluted share in the same period last fiscal year

- Adjusted EBITDA was $85.1 million, or 20.8% of sales, compared to $72.8 million, or 21.0% of sales in the same period last fiscal year

“We are pleased to report another quarter of record sales, crossing one and a half billion in revenue on a trailing twelve month basis. I am incredibly proud of our FOX team members and their unwavering commitment against a backdrop of growing economic headwinds,” commented Mike Dennison, FOX’s Chief Executive Officer. “As the last two years have shown, our agility has been one of our greatest strengths. As we adjust our focus to 2023, which arguably could be more challenging than 2022, we are closely monitoring end-market demand, global resilience and volatility in currency exchange rates. However, even with the heightened risk of a global recession, we remain confident in our ability to achieve our 2025 vision.”

Sales for the third quarter of fiscal 2022 were $409.2 million, an increase of 17.8% as compared to sales of $347.4 million in the third quarter of fiscal 2021. This increase reflects a 25.1% increase in Powered Vehicles Group sales and a 9.1% increase in Specialty Sports Group sales. The increase in Powered Vehicles Group sales is primarily due to strong performance in our upfitting product lines and increased demand in the original equipment manufacturer (“OEM”) channel. The increase in Specialty Sports Group sales is driven by continued strong demand in the OEM channel.

Gross margin was 33.5% for the third quarter of fiscal 2022, a 10 basis point increase from gross margin of 33.4% in the third quarter of fiscal 2021. Non-GAAP adjusted gross margin increased 10 basis points to 33.9% from the same prior fiscal year period, excluding the effects of strategic transformation costs and other non-recurring items. The increase in gross margin was primarily driven by favorable product mix and efficiencies gained at our Gainesville, Georgia facility. A reconciliation of gross profit to non-GAAP adjusted gross profit and the resulting non-GAAP adjusted gross margin is provided at the end of this press release.

Total operating expenses were $71.9 million for the third quarter of fiscal 2022, compared to $60.8 million in the third quarter of fiscal 2021. Operating expenses increased by $11.1 million primarily due to higher employee related costs, insurance and facility-related expenses, commission costs and professional fees. As a percentage of sales, operating expenses for the third quarter of fiscal 2022 were 17.6%, compared to 17.5% in the third quarter of fiscal 2021. Non-GAAP operating expenses were $64.8 million, or 15.8% of sales in the third quarter of fiscal 2022, compared to $53.8 million, or 15.5% of sales, in the third quarter of the prior fiscal year. Reconciliations of operating expense to non-GAAP operating expense are provided at the end of this press release.

The Company’s effective tax rate was 20.8% in the third quarter of fiscal 2022, compared to 18.2% in the third quarter of fiscal 2021. The increase in the Company’s effective tax rate was primarily due to the impact of recently finalized U.S. tax regulations which resulted in an increase in the impact of foreign withholding taxes, net of foreign tax credits. This increase was partially offset by a lower tax rate on foreign derived intangible income.

Net income in the third quarter of fiscal 2022 was $50.8 million, compared to $43.8 million in the third quarter of the prior fiscal year. Earnings per diluted share for the third quarter of fiscal 2022 were $1.20, compared to earnings per diluted share of $1.03 for the third quarter of fiscal 2021.

Non-GAAP adjusted net income in the third quarter of fiscal 2022 was $57.4 million, or $1.35 of adjusted earnings per diluted share, compared to adjusted net income of $50.5 million, or $1.19 of adjusted earnings per diluted share, in the same period of the prior fiscal year. Reconciliations of net income as compared to non-GAAP adjusted net income and the calculation of non-GAAP adjusted earnings per diluted share are provided at the end of this press release.

Adjusted EBITDA in the third quarter of fiscal 2022 was $85.1 million, compared to $72.8 million in the third quarter of fiscal 2021. Adjusted EBITDA margin in the third quarter of fiscal 2022 was 20.8%, compared to 21.0% in the third quarter of fiscal 2021. Reconciliations of net income to adjusted EBITDA and the calculation of adjusted EBITDA margin are provided at the end of this press release.

First Nine Months Fiscal 2022 Results

Sales for the nine months ended September 30, 2022 were $1,193.9 million, an increase of 24.8% compared to the first nine months in fiscal 2021. Sales of Specialty Sports and Powered Vehicle products increased 25.2% and 24.5%, respectively, for the first nine months of fiscal 2022 compared to the prior year fiscal period.

Gross margin was 33.5% in the first nine months of fiscal 2022, a 50 basis point decrease, compared to gross margin of 34.0% in the first nine months of fiscal 2021. On a non-GAAP basis, adjusted gross margin was 33.8% in the first nine months of fiscal 2022, a 40 basis point decrease, compared to 34.2% in the first nine months of fiscal 2021, excluding the effects of strategic transformation costs and other non-recurring items. The decrease in gross margin for the first nine months of fiscal 2022 was primarily driven by continued increases in supply chain related costs, including increased prices for raw materials. Additionally, the completion of the planned shutdown of our Watsonville, California facility and transition of those production lines resulted in inefficiencies as we ramped up our Gainesville, Georgia facility. A reconciliation of gross profit to non-GAAP adjusted gross profit and the resulting non-GAAP adjusted gross margin is provided at the end of this press release.

Net income attributable to FOX stockholders in the first nine months of fiscal 2022 was $152.3 million, compared to $126.1 million in the first nine months of the prior fiscal year. Earnings per diluted share for the first nine months of fiscal 2022 was $3.59, compared to $2.98 in the same period of fiscal 2021.

Non-GAAP adjusted net income in the first nine months of fiscal 2022 was $171.8 million, or $4.06 of adjusted earnings per diluted share, compared to $146.0 million, or $3.45 of adjusted earnings per diluted share in the same period of the prior fiscal year. Reconciliations of net income attributable to FOX stockholders to non-GAAP adjusted net income and the calculation of non-GAAP adjusted earnings per share are provided at the end of this press release.

Adjusted EBITDA increased to $245.0 million in the first nine months of fiscal 2022, compared to $202.9 million in the first nine months of fiscal 2021. Adjusted EBITDA margin decreased to 20.5% in the first nine months of fiscal 2022, compared to 21.2% in the first nine months of fiscal 2021. Reconciliations of net income to adjusted EBITDA and the calculation of non-GAAP adjusted EBITDA margin are provided at the end of this press release.

Balance Sheet Highlights

As of September 30, 2022, the Company had cash and cash equivalents of $153.1 million compared to $179.7 million as of December 31, 2021. Inventory was $354.2 million as of September 30, 2022, compared to $279.8 million as of December 31, 2021. As of September 30, 2022, accounts receivable and accounts payable were $194.4 million and $131.7 million, respectively, compared to $142.0 million and $100.0 million, respectively, as of December 31, 2021. Prepaids and other current assets were $175.4 million as of September 30, 2022, compared to $123.1 million as of December 31, 2021. The increase in cash used for working capital was primarily due to increased inventory, accounts receivable, as well as prepaids and other current assets. The increase in prepaids and other current assets is primarily due to increased chassis deposits as we work to secure supply for the remainder of the year for our upfitting business. The increase in inventory is due to several factors, including receipt of long lead time items that had been delayed, higher levels of safety stock to mitigate uncertainty, and natural growth to meet anticipated demand. The increases in accounts receivable and accounts payable reflect business growth as well as the timing of vendor payments. Total debt was $325.0 million as of September 30, 2022, compared to $378.5 million as of December 31, 2021, due to additional payments made on our line of credit.

Fiscal 2022 Guidance

For the fourth quarter of fiscal 2022, the Company expects sales in the range of $370 million to $390 million and non-GAAP adjusted earnings per diluted share in the range of $1.10 to $1.30.

For the fiscal year 2022, the Company expects sales in the range of $1,565 million to $1,585 million and non-GAAP adjusted earnings per diluted share in the range of $5.15 to $5.35. For purposes of our fiscal 2022 guidance, we expect our full year effective tax rate to be approximately 16%.

Non-GAAP adjusted earnings per diluted share exclude the following items net of applicable tax: amortization of purchased intangibles, litigation and settlement related expenses, acquisition and integration-related expenses, strategic transformation costs and other non-recurring items. A quantitative reconciliation of non-GAAP adjusted earnings per diluted share for the fourth quarter and full fiscal year 2022 is not available without unreasonable efforts because management cannot predict, with sufficient certainty, all of the elements necessary to provide such a reconciliation.

Conference Call & Webcast

The Company will hold an investor conference call today at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time). The conference call dial-in number for North America listeners is (800) 274-8461, and international listeners may dial (203) 518-9814; the conference ID is FOXFQ322 or 36937322. Live audio of the conference call will be simultaneously webcast in the Investor Relations section of the Company’s website at http://www.ridefox.com. The webcast of the teleconference will be archived and available on the Company’s website.

About Fox Factory Holding Corp. (NASDAQ: FOXF)

Fox Factory Holding Corp. designs and manufactures performance-defining ride dynamics products primarily for bicycles, on-road and off-road vehicles and trucks, side-by-side vehicles, all-terrain vehicles, snowmobiles, specialty vehicles and applications, motorcycles, and commercial trucks. The Company is a direct supplier to leading powered vehicle OEMs. Additionally, the Company supplies top bicycle OEMs and their contract manufacturers, and provides aftermarket products to retailers and distributors.

FOX is a registered trademark of Fox Factory, Inc. NASDAQ Global Select Market is a registered trademark of The NASDAQ OMX Group, Inc. All rights reserved.

Non-GAAP Financial Measures

In addition to reporting financial measures in accordance with generally accepted accounting principles (“GAAP”), FOX is including in this press release “non-GAAP adjusted gross profit,” “non-GAAP adjusted gross margin,” “non-GAAP operating expense,” “non-GAAP adjusted net income,” “non-GAAP adjusted earnings per diluted share,” “adjusted EBITDA,” and “adjusted EBITDA margin,” all of which are non-GAAP financial measures. FOX defines non-GAAP adjusted gross profit as gross profit margin adjusted for certain strategic transformation costs and other non-recurring items. Non-GAAP adjusted gross margin is defined as non-GAAP adjusted gross profit divided by total sales. FOX defines non-GAAP operating expense as operating expense adjusted for amortization of purchased intangibles, litigation and settlement related expenses, acquisition and integration-related expenses, and strategic transformation costs. FOX defines non-GAAP adjusted net income as net income adjusted for amortization of purchased intangibles, litigation and settlement related expenses, acquisition and integration-related expenses, strategic transformation costs and other non-recurring items, all net of applicable tax. These adjustments are more fully described in the tables included at the end of this press release. Non-GAAP adjusted earnings per diluted share is defined as non-GAAP adjusted net income divided by the weighted average number of diluted shares of common stock outstanding during the period. FOX defines adjusted EBITDA as net income adjusted for interest expense, net other expense, income taxes, amortization of purchased intangibles, depreciation, stock-based compensation, litigation and settlement related expenses, acquisition and integration-related expenses, strategic transformation costs and other non-recurring items that are more fully described in the tables included at the end of this press release. Adjusted EBITDA margin is defined as adjusted EBITDA divided by sales.

FOX includes these non-GAAP financial measures because it believes they allow investors to understand and evaluate the Company’s core operating performance and trends. In particular, the exclusion of certain items in calculating non-GAAP adjusted gross profit, non-GAAP operating expense, non-GAAP adjusted net income and adjusted EBITDA (and accordingly, non-GAAP adjusted gross margin, non-GAAP adjusted earnings per diluted share and adjusted EBITDA margin) can provide a useful measure for period-to-period comparisons of the Company’s core business. These non-GAAP financial measures have limitations as analytical tools, including the fact that such non-GAAP financial measures may not be comparable to similarly titled measures presented by other companies because other companies may calculate non-GAAP adjusted gross profit, non-GAAP adjusted gross margin, non-GAAP operating expense, non-GAAP adjusted net income, non-GAAP adjusted earnings per diluted share, adjusted EBITDA and adjusted EBITDA margin differently than FOX does. For more information regarding these non-GAAP financial measures, see the tables included at the end of this press release.

| FOX FACTORY HOLDING CORP. Condensed Consolidated Balance Sheets (in thousands, except per share data) (unaudited) | |||||||

| As of | As of | ||||||

| September 30, | December 31 | ||||||

| 2022 | 2021 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 153,137 | $ | 179,686 | |||

| Accounts receivable (net of allowances of $455 and $410 at September 30, 2022 and December 31, 2021, respectively) | 194,422 | 142,040 | |||||

| Inventory | 354,223 | 279,837 | |||||

| Prepaids and other current assets | 175,360 | 123,107 | |||||

| Total current assets | 877,142 | 724,670 | |||||

| Property, plant and equipment, net | 199,568 | 192,003 | |||||

| Lease right-of-use assets | 41,524 | 38,752 | |||||

| Deferred tax assets | 44,378 | 34,998 | |||||

| Goodwill | 323,931 | 323,299 | |||||

| Intangibles, net | 180,800 | 197,021 | |||||

| Other assets | 10,522 | 4,986 | |||||

| Total assets | $ | 1,677,865 | $ | 1,515,729 | |||

| Liabilities and stockholders’ equity | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 131,659 | $ | 99,984 | |||

| Accrued expenses | 133,432 | 112,378 | |||||

| Current portion of long-term debt | — | 17,500 | |||||

| Total current liabilities | 265,091 | 229,862 | |||||

| Line of credit | 325,000 | — | |||||

| Long-term debt, less current portion | — | 360,953 | |||||

| Other liabilities | 32,640 | 30,832 | |||||

| Total liabilities | 622,731 | 621,647 | |||||

| Stockholders’ equity | |||||||

| Preferred stock, $0.001 par value — 10,000 authorized and no shares issued or outstanding as of September 30, 2022 and December 31, 2021 | — | — | |||||

| Common stock, $0.001 par value — 90,000 authorized; 43,157 shares issued and 42,267 outstanding as of September 30, 2022; 43,010 shares issued and 42,120 outstanding as of December 31, 2021 | 42 | 42 | |||||

| Additional paid-in capital | 351,403 | 344,119 | |||||

| Treasury stock, at cost; 890 common shares as of September 30, 2022 and December 31, 2021 | (13,754 | ) | (13,754 | ) | |||

| Accumulated other comprehensive income | 6,325 | 4,876 | |||||

| Retained earnings | 711,118 | 558,799 | |||||

| Total stockholders’ equity | 1,055,134 | 894,082 | |||||

| Total liabilities and stockholders’ equity | $ | 1,677,865 | $ | 1,515,729 | |||

| FOX FACTORY HOLDING CORP. Condensed Consolidated Statements of Income (in thousands, except per share data) (unaudited) | |||||||||||||

| For the three months ended | For the nine months ended | ||||||||||||

| September 30, | October 1, | September 30, | October 1, | ||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||

| Sales | $ | 409,168 | $ | 347,435 | $ | 1,193,850 | $ | 956,735 | |||||

| Cost of sales | 271,901 | 231,417 | 793,379 | 631,705 | |||||||||

| Gross profit | 137,267 | 116,018 | 400,471 | 325,030 | |||||||||

| Operating expenses: | |||||||||||||

| Sales and marketing | 23,508 | 17,517 | 70,272 | 52,215 | |||||||||

| Research and development | 13,955 | 12,318 | 40,811 | 33,410 | |||||||||

| General and administrative | 29,171 | 25,614 | 83,182 | 70,209 | |||||||||

| Amortization of purchased intangibles | 5,271 | 5,320 | 16,214 | 15,368 | |||||||||

| Total operating expenses | 71,905 | 60,769 | 210,479 | 171,202 | |||||||||

| Income from operations | 65,362 | 55,249 | 189,992 | 153,828 | |||||||||

| Interest and other (income) expense, net: | |||||||||||||

| Interest expense | 2,667 | 1,849 | 6,341 | 6,351 | |||||||||

| Other (income) expense, net | (1,441 | ) | (187 | ) | 3,067 | 855 | |||||||

| Interest and other (income) expense, net | 1,226 | 1,662 | 9,408 | 7,206 | |||||||||

| Income before income taxes | 64,136 | 53,587 | 180,584 | 146,622 | |||||||||

| Provision for income taxes | 13,365 | 9,764 | 28,265 | 20,538 | |||||||||

| Net income | $ | 50,771 | $ | 43,823 | $ | 152,319 | $ | 126,084 | |||||

| Earnings per share: | |||||||||||||

| Basic | $ | 1.20 | $ | 1.04 | $ | 3.61 | $ | 3.00 | |||||

| Diluted | $ | 1.20 | $ | 1.03 | $ | 3.59 | $ | 2.98 | |||||

| Weighted-average shares used to compute earnings per share: | |||||||||||||

| Basic | 42,281 | 42,097 | 42,215 | 41,992 | |||||||||

| Diluted | 42,387 | 42,363 | 42,374 | 42,357 | |||||||||

FOX FACTORY HOLDING CORP.

NET INCOME TO NON-GAAP ADJUSTED NET INCOME RECONCILIATION

AND CALCULATION OF NON-GAAP ADJUSTED EARNINGS PER SHARE

(in thousands, except per share data)

(unaudited)

The following table provides a reconciliation of net income, the most directly comparable financial measure calculated and presented in accordance with GAAP, to non-GAAP adjusted net income (a non-GAAP measure), and the calculation of non-GAAP adjusted earnings per share (a non-GAAP measure) for the three and nine months ended September 30, 2022 and October 1, 2021. These non-GAAP financial measures are provided in addition to, and not as alternatives for, the Company’s reported GAAP results.

| For the three months ended | For the nine months ended | ||||||||||||||

| September 30, | October 1, | September 30, | October 1, | ||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||

| Net income | $ | 50,771 | $ | 43,823 | $ | 152,319 | $ | 126,084 | |||||||

| Amortization of purchased intangibles | 5,271 | 5,320 | 16,214 | 15,368 | |||||||||||

| Litigation and settlement related expenses | 1,395 | 230 | 1,596 | 698 | |||||||||||

| Other acquisition and integration-related expenses (1) | 414 | 1,370 | 1,712 | 4,522 | |||||||||||

| Strategic transformation costs (2) | 430 | 1,282 | 2,769 | 2,571 | |||||||||||

| Non-recurring property tax assessment (3) | 841 | — | 841 | — | |||||||||||

| Tax impacts of reconciling items above (4) | (1,730 | ) | (1,519 | ) | (3,621 | ) | (3,251 | ) | |||||||

| Non-GAAP adjusted net income | $ | 57,392 | $ | 50,506 | $ | 171,830 | $ | 145,992 | |||||||

| Non-GAAP adjusted EPS | |||||||||||||||

| Basic | $ | 1.36 | $ | 1.20 | $ | 4.07 | $ | 3.48 | |||||||

| Diluted | $ | 1.35 | $ | 1.19 | $ | 4.06 | $ | 3.45 | |||||||

| Weighted average shares used to compute non-GAAP adjusted EPS | |||||||||||||||

| Basic | 42,281 | 42,097 | 42,215 | 41,992 | |||||||||||

| Diluted | 42,387 | 42,363 | 42,374 | 42,357 |

(1) Represents various acquisition-related costs and expenses incurred to integrate acquired entities into the Company’s operations.

(2) Represents costs associated with various strategic initiatives including the expansion of the Powered Vehicles Group’s manufacturing operations. For the three and nine month periods ended September 30, 2022, $430 and $2,769 is classified as costs of sales, respectively. For the three and nine month periods ended October 1, 2021, $1,282 and $2,571 is classified as cost of sales, respectively.

(3) Represents amounts paid for a non-recurring property tax assessment.

(4) Tax impact calculated based on the respective year to date effective tax rate.

FOX FACTORY HOLDING CORP.

NET INCOME TO ADJUSTED EBITDA RECONCILIATION AND

CALCULATION OF NET INCOME MARGIN AND ADJUSTED EBITDA MARGIN

(in thousands)

(unaudited)

The following tables provide a reconciliation of net income, the most directly comparable financial measure calculated and presented in accordance with GAAP, to adjusted EBITDA (a non-GAAP measure), and the calculations of net income margin and adjusted EBITDA margin (a non-GAAP measure) for the three and nine months ended September 30, 2022 and October 1, 2021. These non-GAAP financial measures are provided in addition to, and not as alternatives for, the Company’s reported GAAP results.

| For the three months ended | For the nine months ended | ||||||||||||||

| September 30, | October 1, | September 30, | October 1, | ||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||

| Net income | $ | 50,771 | $ | 43,823 | $ | 152,319 | $ | 126,084 | |||||||

| Provision for income taxes | 13,365 | 9,764 | 28,265 | 20,538 | |||||||||||

| Depreciation and amortization | 12,403 | 10,875 | 36,813 | 31,906 | |||||||||||

| Non-cash stock-based compensation | 4,289 | 3,986 | 11,379 | 9,854 | |||||||||||

| Litigation and settlement related expenses | 1,395 | 230 | 1,596 | 698 | |||||||||||

| Other acquisition and integration-related expenses (1) | 414 | 1,210 | 1,598 | 4,041 | |||||||||||

| Strategic transformation costs (2) | 430 | 1,282 | 2,769 | 2,571 | |||||||||||

| Non-recurring property tax assessment (3) | 841 | — | 841 | — | |||||||||||

| Interest and other (income) expense, net | 1,226 | 1,662 | 9,408 | 7,206 | |||||||||||

| Adjusted EBITDA | $ | 85,134 | $ | 72,832 | $ | 244,988 | $ | 202,898 | |||||||

| Net Income Margin | 12.4 | % | 12.6 | % | 12.8 | % | 13.2 | % | |||||||

| Adjusted EBITDA Margin | 20.8 | % | 21.0 | % | 20.5 | % | 21.2 | % |

(1) Represents various acquisition-related costs and expenses incurred to integrate acquired entities into the Company’s operations, excluding $114 in stock-based compensation for the nine month period ended September 30, 2022, and $160 and $481 of stock-based compensation for the three and nine month periods ended October 1, 2021, respectively.

(2) Represents costs associated with various strategic initiatives including the expansion of the Powered Vehicles Group’s manufacturing operations. For the three and nine month periods ended September 30, 2022, $430 and $2,769 is classified as costs of sales, respectively. For the three and nine month periods ended October 1, 2021, $1,282 and $2,571 is classified as cost of sales, respectively.

(3) Represents amounts paid for a non-recurring property tax assessment.

FOX FACTORY HOLDING CORP.

GROSS PROFIT TO NON-GAAP ADJUSTED GROSS PROFIT RECONCILIATION AND

CALCULATION OF GROSS MARGIN AND NON-GAAP ADJUSTED GROSS MARGIN

(in thousands)

(unaudited)

The following table provides a reconciliation of gross profit to non-GAAP adjusted gross profit (a non-GAAP measure) for the three and nine months ended September 30, 2022 and October 1, 2021, and the calculation of gross margin and non-GAAP adjusted gross margin (a non-GAAP measure). These non-GAAP financial measures are provided in addition to, and not as alternatives for, the Company’s reported GAAP results.

| For the three months ended | For the nine months ended | ||||||||||||||

| September 30, | October 1, | September 30, | October 1, | ||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||

| Sales | $ | 409,168 | $ | 347,435 | $ | 1,193,850 | $ | 956,735 | |||||||

| Gross Profit | $ | 137,267 | $ | 116,018 | $ | 400,471 | $ | 325,030 | |||||||

| Strategic transformation costs (1) | 430 | 1,282 | 2,769 | 2,571 | |||||||||||

| Non-recurring property tax assessment (2) | 841 | — | 841 | — | |||||||||||

| Non-GAAP Adjusted Gross Profit | $ | 138,538 | $ | 117,300 | $ | 404,081 | $ | 327,601 | |||||||

| Gross Margin | 33.5 | % | 33.4 | % | 33.5 | % | 34.0 | % | |||||||

| Non-GAAP Adjusted Gross Margin | 33.9 | % | 33.8 | % | 33.8 | % | 34.2 | % |

(1) Represents costs associated with various strategic initiatives including the expansion of the Powered Vehicles Group’s manufacturing operations.

(2) Represents amounts paid for a non-recurring property tax assessment.

FOX FACTORY HOLDING CORP.

OPERATING EXPENSE TO NON-GAAP OPERATING EXPENSE RECONCILIATION AND

CALCULATION OF OPERATING EXPENSE AND NON-GAAP OPERATING EXPENSE AS A PERCENTAGE OF SALES

(in thousands)

(unaudited)

The following tables provide a reconciliation of operating expense to non-GAAP operating expense (a non-GAAP measure) and the calculations of operating expense as a percentage of sales and non-GAAP operating expense as a percentage of sales (a non-GAAP measure), for the three and nine months ended September 30, 2022 and October 1, 2021. These non-GAAP financial measures are provided in addition to, and not as an alternative for, the Company’s reported GAAP results.

| For the three months ended | For the nine months ended | ||||||||||||||

| September 30, | October 1, | September 30, | October 1, | ||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||

| Sales | $ | 409,168 | $ | 347,435 | $ | 1,193,850 | $ | 956,735 | |||||||

| Operating Expense | $ | 71,905 | $ | 60,769 | $ | 210,479 | $ | 171,202 | |||||||

| Amortization of purchased intangibles | (5,271 | ) | (5,320 | ) | (16,214 | ) | (15,368 | ) | |||||||

| Litigation and settlement related expenses | (1,395 | ) | (230 | ) | (1,596 | ) | (698 | ) | |||||||

| Other acquisition and integration-related expenses (1) | (414 | ) | (1,370 | ) | (1,712 | ) | (4,522 | ) | |||||||

| Non-GAAP operating expense | $ | 64,825 | $ | 53,849 | $ | 190,957 | $ | 150,614 | |||||||

| Operating expense as a percentage of sales | 17.6 | % | 17.5 | % | 17.6 | % | 17.9 | % | |||||||

| Non-GAAP operating expense as a percentage of sales | 15.8 | % | 15.5 | % | 16.0 | % | 15.7 | % |

(1) Represents various acquisition-related costs and expenses incurred to integrate acquired entities into the Company’s operations.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release including earnings guidance may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends that all such statements be subject to the “safe-harbor” provisions contained in those sections. Forward-looking statements generally relate to future events or the Company’s future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “might,” “will,” “would,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “likely,” “potential” or “continue” or other similar terms or expressions and such forward-looking statements include, but are not limited to, statements about the impact of the global outbreak of COVID-19 on the Company’s business and operations; the Company’s continued growing demand for its products; the Company’s execution on its strategy to improve operating efficiencies; the Company’s optimism about its operating results and future growth prospects; the Company’s expected future sales and future non-GAAP adjusted earnings per diluted share; and any other statements in this press release that are not of a historical nature. Many important factors may cause the Company’s actual results, events or circumstances to differ materially from those discussed in any such forward-looking statements, including but not limited to: the Company’s ability to complete any acquisition and/or incorporate any acquired assets into its business; the Company’s ability to maintain its suppliers for materials, product parts and vehicle chassis without significant supply chain disruptions; the Company’s ability to improve operating and supply chain efficiencies; the Company’s ability to enforce its intellectual property rights; the Company’s future financial performance, including its sales, cost of sales, gross profit or gross margin, operating expenses, ability to generate positive cash flow and ability to maintain profitability; the Company’s ability to adapt its business model to mitigate the impact of certain changes in tax laws; changes in the relative proportion of profit earned in the numerous jurisdictions in which the Company does business and in tax legislation, case law and other authoritative guidance in those jurisdictions; factors which impact the calculation of the weighted average number of diluted shares of common stock outstanding, including the market price of the Company’s common stock, grants of equity-based awards and the vesting schedules of equity-based awards; the Company’s ability to develop new and innovative products in its current end-markets and to leverage its technologies and brand to expand into new categories and end-markets; the Company’s ability to increase its aftermarket penetration; the Company’s exposure to exchange rate fluctuations; the loss of key customers; strategic transformation costs; the outcome of pending litigation; the possibility that the Company may not be able to accelerate its international growth; the Company’s ability to maintain its premium brand image and high-performance products; the Company’s ability to maintain relationships with the professional athletes and race teams that it sponsors; the possibility that the Company may not be able to selectively add additional dealers and distributors in certain geographic markets; the overall growth of the markets in which the Company competes; the Company’s expectations regarding consumer preferences and its ability to respond to changes in consumer preferences; changes in demand for high-end suspension and ride dynamics products; the Company’s loss of key personnel, management and skilled engineers; the Company’s ability to successfully identify, evaluate and manage potential acquisitions and to benefit from such acquisitions; product recalls and product liability claims; the impact of change in China-Taiwan relations on our business, our operations or our supply chain, the impact of the Russian invasion of Ukraine on the global economy, energy supplies and raw materials; future economic or market conditions, including the impact of inflation or the U.S. Federal Reserve’s interest rate increases in response thereto; and the other risks and uncertainties described in “Risk Factors” contained in its Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and filed with the Securities and Exchange Commission on February 24, 2022, or Quarterly Reports on Form 10-Q or otherwise described in the Company’s other filings with the Securities and Exchange Commission. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the Company’s expectations, objectives or plans will be achieved in the timeframe anticipated or at all. Investors are cautioned not to place undue reliance on the Company’s forward-looking statements and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

CONTACT:

Fox Factory Holding Corp.

Vivek Bhakuni

Sr. Director of Investor Relations and Business Development

706-471-5241

vbhakuni@ridefox.com

8 – Polaris Declares Regular Cash Dividend – From Polaris Inc

Polaris Inc. (NYSE: PII) announced today that its Board of Directors has declared a regular quarterly cash dividend of $0.64 per share payable on December 15, 2022 to shareholders of record at the close of business on December 1, 2022.

About Polaris

As the global leader in powersports, Polaris Inc. (NYSE: PII) pioneers product breakthroughs and enriching experiences and services that have invited people to discover the joy of being outdoors since our founding in 1954. Polaris’ high-quality product line-up includes the Polaris RANGER®, RZR® and Polaris GENERAL™ side-by-side off-road vehicles; Sportsman® all-terrain off-road vehicles; military and commercial off-road vehicles; snowmobiles; Indian Motorcycle® mid-size and heavyweight motorcycles; Slingshot® moto-roadsters; Aixam quadricycles; Goupil electric vehicles; and pontoon and deck boats, including industry-leading Bennington pontoons. Polaris enhances the riding experience with a robust portfolio of parts, garments, and accessories. Proudly headquartered in Minnesota, Polaris serves more than 100 countries across the globe. www.polaris.com